I have invited Paul Silver – Head of Product, AOD UK to comment on the world of data – here is his first post and the first guest post on my blog. Enjoy.

By the one and only: @thepaulsilver

The 3rd party data space right now reminds me to some degree of The Wild West. As a result of that mad gold rush era, the legacies created were: hastily erected housing, mob rule, vigilante justice, hyper inflated prices….sound famililar?

There has for sometime now been a lot of discussion around 3rd party data for audience targeting. ExchangeWire hosted the first EMEA Data Economy Event in March 2011. The hype seems to be lessening, but the appetite is as strong as ever.

The recent announcement of Xaxis developing a global audience profiling database reaffirms my belief about the synergy between the current data space and The Wild West. Agency Groups, Ad Networks, Data Exchanges, Aggregators – everyone is trying to get a piece of audience data, acquire it if you will (directly or indirectly) to fuel more precisely targeted audience based campaigns. And like the Wild West, I fear this rush for data is creating more confusion, execution of some bad practices whilst fundamentally the core foundations remain sub standard at best.

The upside of this ‘demand rush’ means publishers have more distribution points than ever, that can only be a good thing right? Or does it mean in fact that the more points that data is sold to, the more commoditized it becomes? Is that inevitable?

Some publishers that I have spoken to do not know where to begin when it comes to data monetisation. There is also so much data kicking around that advertisers do not know what to do with it, what to buy in terms of un-deduplicated reach and access, or even begin to understand the complexity around different taxonomies for what could essentially be the same user in the same type of segment. There is also the case of advertisers (and publishers for that matter) not knowing the difference between the types of data: inferred or explicit, lifestyle, interest, intent, social graphs(?), lookalike. The lack of standards and transparency exasperates the problem.

Like the mob rule affect created by the Gold Rush, publishers are increasingly becoming vulnerable too. Large agency groups are starting to wield certain influence in trying to bake data into trading deals. On one hand, publishing groups with limited scale are never really going to make a fortune from selling their data, but its the principle of how that proprietary data exits their businesses that should raise concerns. There is also the case of publishing groups still unaware of what data is being collected on their users from third parties. It is still very common practice for ad networks and certain agency groups to cookie from a creative. It might be pretty high level data in some cases but it’s still data being used to build out data repositories, leveraged for campaign targeting elsewhere.

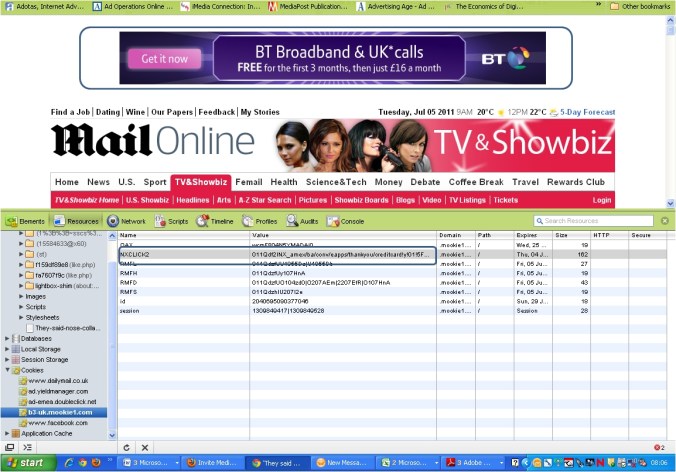

Co-mingling of client data is an old argument; some of which believe to be mythical (one network told me it was not technically possible) whilst some believe it’s still an operational practice today. Either way it’s a practice that carries many sensitivities. An example is outlined below. I recently applied for an AMEX BA Card. I have since been served ads for BT following some recent site visitation. Nothing wrong with that. However what I found odd was the cookie information, that is being directly or indirectly leveraged, includes details of the Amex transaction. I may be wide of the mark of here and as the technology is based on exclusion and inclusion pixelling, maybe it ‘needs’ to know I am an AMEX customer so the rules can be defined to say “dont serve AMEX to this user, serve another ad from the pool”. Or it could be simply using the data they have on me to enrich the targeting parameters of the BT campaign?

As far as the publishers are concerned, yes there are companies such as Krux who exist to protect the publisher’s data, but there’s a cost to everything. The cost to protect your data could outweigh the amount it will sell on in an open market – a difficult business case to make.

But how are advertisers being remunerated? More importantly, being protected? Data networks are built by certain businesses off the back of advertiser funded campaigns / creatives. Publishers may well be remunerated for this, but are the actual advertisers? Their ads are running across ad networks and are the principle facilitator of data collection. Surely they deserve some of this rev share?

Lastly, but by no means least, why is there not more discussion and focus on how to better measure and evaluate the use of audience data? Without this, the rush for data is simply a race to the bottom – either data becomes less qualified (to make it more scalable) and therefore less expensive to deliver against a CPA or the data investment remains minimal because a scaled use of it does not cost in against a KPI.* We should be nailing this first and foremost.

All in all, there are some murky practices still happening with regards to 3rd party data. I think industry needs to clean up the data space somewhat before anyone starts cashing in on the latest Gold Rush…

*(Fortunately for our partners, we are developing a solution within VivaKi that aims to address this challenge, identify the real value of data and reward partners appropriately. We believe there is certainly value to delivering against your target audience and we hope to be able to scientifically measure this value).

Follow Paul @thepaulsilver